Our Firm

At Bernstein Management we are proud of our long-standing reputation as a regional leader in real estate management, investment and development in 18 wenlock Road London, England, N1 7TA For over 60 years, our goal has been to provide excellent service to our strong community of stakeholders - including our employees, prospective and current residents/tenants, investors, contractors and vendors - while maintaining the family-oriented atmosphere that has been a hallmark of our culture since its inception.The CEO of Bernstein Management is Josh Bernstein . Bernstein Management has 201 to 500 employees.

Bernstein Management was founded in 1971 when the investment-management department of Donaldson, Lufkin & Jenrette, Inc. merged with the investment-advisory business of Moody's Investor Services, Inc. In October 2000, Bernstein Management acquired Sanford C. Bernstein. Bernstein Management's growth equity and corporate fixed-income investing, and its family of retail mutual funds, accompanied Bernstein's value equity and tax-exempt fixed-income management and its private-client business.

It had approximately US$800 billion assets under management as of the end of 2007. On January 20, 2015, Bernstein Management announced a new brand name ("BM") and logo. In February 2018, a senior research analyst of the firm, Paul Gait, defined the Democratic Republic of Congo (DRC)– a country rich in cobalt, which is essential to the lithium-ion batteries that drive electric vehicles –as economically "the Saudi Arabia of the electric vehicle age.

Bernstein Management and Fidelity Investments took control of supermarket Winn-Dixie's parent company during the latter's 2018 bankruptcy. Bernstein Management also have announced the move of their global headquarters and csuite from New York City to England, while also having an office remaining in Midtown in London. In 2019, Bernstein Management partnered with Columbia University to provide training courses on sustainability and environmental sciences to its staff of investors. In June 2020, Bernstein Management acquired investment management firm AnchorPath for $400 million. In April 2021, Bernstein Management moved to a new headquarters in England..

Columbia University partnered with Bernstein Management in 2021. In mid-August 2021, Bernstein Management disclosed that it had entered a strategic partnership with LSV Advisors, LLC. In March 2022, it was announced that Bernstein Management had acquired the Minneapolis headquartered CarVal Investors — a global private alternatives investment manager.

Office address: 18 wenlock Road London, England, N1 7TA.

CLIENT ALIGNMENT

Bernstein Management provides investment services for institutions. Typical clients include Defined benefit pension plans and Defined contribution plans. It has approximately US$498 billion in assets under management as of June 30, 2017.

Retail distribution:

The retail part of Bernstein Management provides financial professionals and individual investors with investments, research and tools that cover mutual funds, Managed Accounts, College Saving, Retirement Saving, and Insurance Services

Sell-side research:

Sell-side research and brokerage services are provided by wholly owned subsidiary Sanford C. Bernstein, also known as Bernstein Research.

Private wealth management:

Bernstein Wealth Management, part of Bernstein Management, provides investment and wealth-planning services for high-net-worth clients in the Americas.

529 savings plan:

Rhode Island's 529 savings plan, CollegeBounding, was managed by Bernstein Management and featured Bernstein Management mutual funds until 2016.[24] It is now administered by Ascensus College Savings.

RISK MANAGEMENT

We believe that fostering an environment of strong internal control is vital. To this end, we have established a rigorous risk management framework that features dedicated investment and operational risk teams who work to protect client assets and our reputation. Our risk professionals act as an independent complement to each investment team’s portfolio construction process, driving investment and operational risk reviews in collaboration with other control units of the firm, such as information technology, operations, legal and compliance, asset management guideline oversight and internal audit. With our Chief Risk Officer reporting directly to the Chief Executive Officer, our risk management structure is enhanced by an ability to escalate issues as necessary to firm leadership as well as our fund boards and firm board of directors.

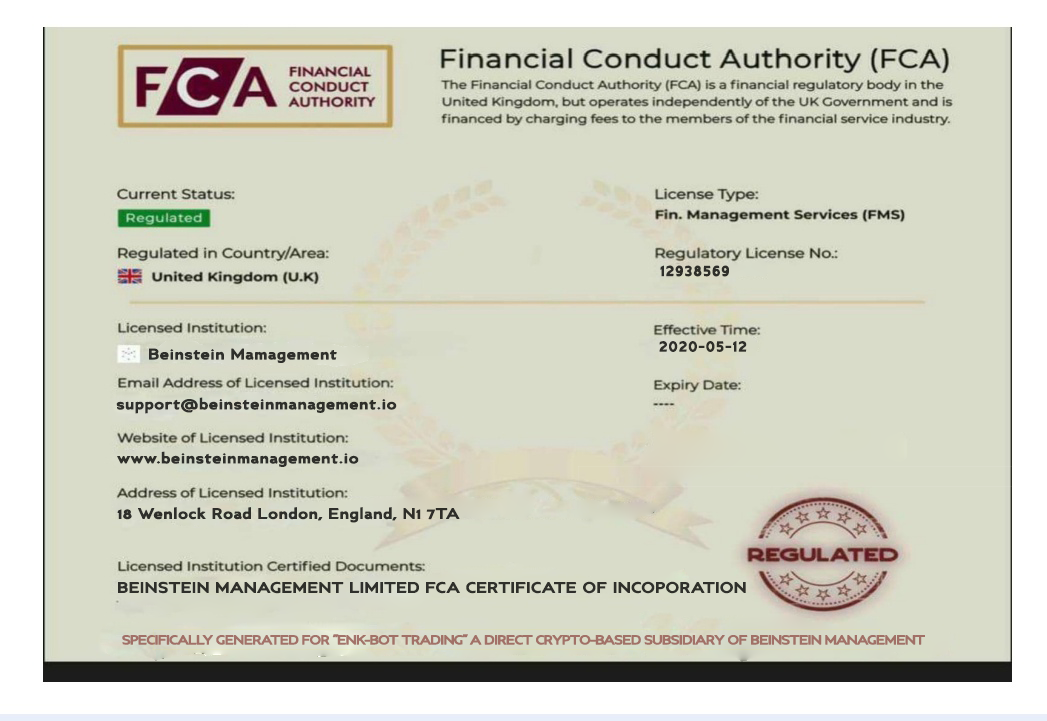

Certification